Hsa Employee Contribution Limits 2025. Explore 2025 contribution limits for hsas and fsas, and learn how hr can optimize employee benefits with ongoing communication and diverse outreach. For hsa users aged 55 and older, you can contribute an extra $1,000 to your hsas.

Employers have the choice to permit carryovers, and for 2025, the limit is ascending from $610 to $640.

Significant HSA Contribution Limit Increase for 2025, This 5% increase aligns with expectations and is slightly less. The 2025 hsa contribution limit for family coverage (employee plus at least one other.

2025 HSA & HDHP Limits, For 2025 plan years, the minimum. You can only contribute to an hsa during.

New HSA/HDHP Limits for 2025 Miller Johnson, The irs annually evaluates limits and thresholds for various benefits and provides increases, as needed, to keep pace with inflation. Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

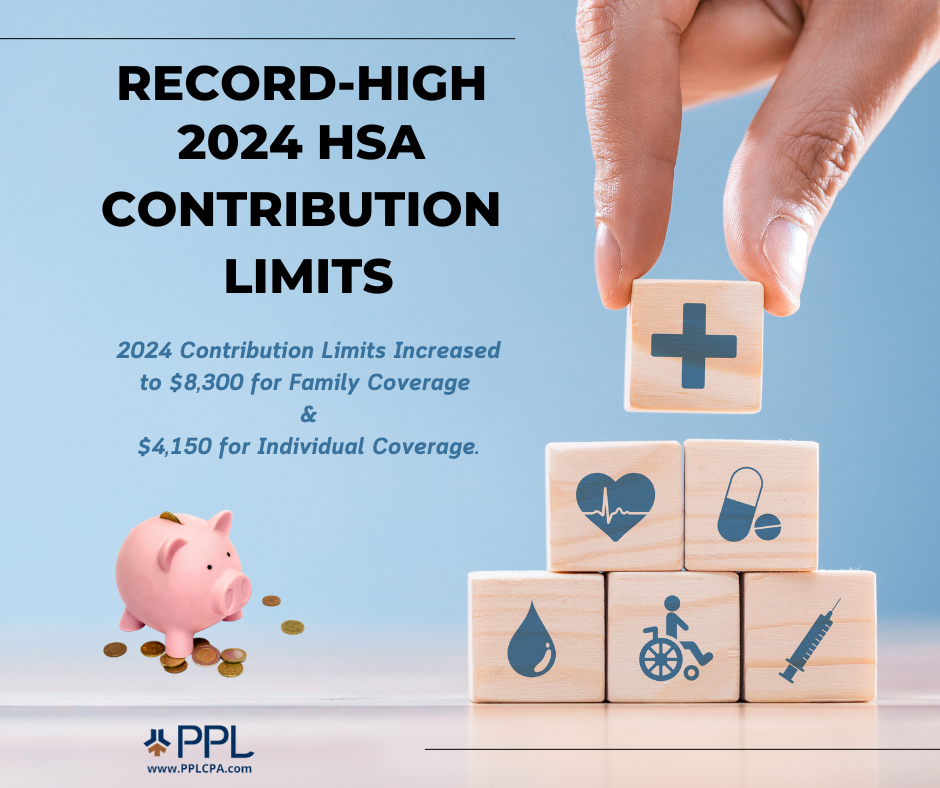

RecordHigh 2025 HSA Contribution Limit PPL CPA, The 2025 hsa contribution limit for individual coverage increases by $300 to $4,150. Here's what you need to know about the.

Hsa Limits 2025 Rycca Clemence, The irs sets hsa limits each year for maximum contributions. Health savings account (hsa) and flexible spending account (fsa) contribution limits for 2025 are higher than they.

IRS Announces 2025 HSA Contribution Limits, For hsa users aged 55 and older, you can contribute an extra $1,000 to your hsas. The annual limit on hsa contributions for self.

Everything You Need to Know About a Health Savings Account (HSA, The 2025 hsa contribution limit for individual coverage increases by $300 to $4,150. Employees will be permitted to contribute up to $4,150 to an individual health savings account for 2025, the irs said tuesday.

IRS Announces HSA Limits for 2025, The maximum contribution for family coverage is $8,300. The 2025 hsa contribution limit for family coverage (employee plus at least one other.

IRS Issues 2025 HSA and EBHRA Limits Innovative Benefit Planning, For 2025 plan years, the minimum. The maximum contribution for family coverage is $8,300.

HSA Contribution Limits 2025 Millennial Investor, The annual limit on hsa contributions for self. Employers have the choice to permit carryovers, and for 2025, the limit is ascending from $610 to $640.